- Jul 20, 2023

- 11 min

Navigating the challenges of digital transformation in the insurance business

Magnolia in action

Take 12 minutes and a coffee break to discover how Magnolia can elevate your digital experience.

Digital transformation has become a buzzword in many industries, including insurance. With the rise of new, disruptive technologies, changing customer expectations, and increasing competition, insurers are pressured to modernize their operations, improve customer experience, and stay ahead of the curve. Understandably, some insurance companies still prefer to use personal channels to stay in touch with their customers and carry out certain processes. However, most processes that require manual intervention can be done digitally without necessarily sacrificing that personal connection with their customers. To achieve this, insurers must adopt a comprehensive digital strategy encompassing all aspects of their business. This is where Digital Experience Platforms (DXPs) come in. In this article, we will explore the role of DXP in revolutionizing the insurance sector and how it can help insurers stay competitive in the digital age.

What is digital transformation, anyways?

Digital transformation refers to integrating digital technologies into all aspects of a business to fundamentally change how it operates and delivers value to its customers. In the insurance sector, digital transformation has become imperative to stay competitive and meet customers' evolving needs.

One of the key trends driving disruptive innovation in the insurance industry is the increasing use of data and advanced analytics. Machine learning (ML) and artificial intelligence (AI) are being used to analyze data and provide insights that can be used to make more informed decisions. This increased the emphasis on data-driven decision-making, allowing insurers to understand customer behavior and preferences better.

Another trend is the increasing use of virtual care and telemedicine. With the COVID-19 pandemic, there has been a surge in demand for telehealth services, including virtual consultations and remote monitoring. Insurers leverage these technologies to improve customer experiences and improve healthcare outcomes.

Telematics is another area where digital evolution is having a significant impact. Telematics devices are being used to collect data on driving behavior, allowing insurers to offer more personalized and usage-based insurance policies…thus providing more value to customers and helping insurers assess risk better and set premiums more accurately.

Despite the potential benefits, digital evolution in the insurance sector poses significant challenges. One of the main challenges is legacy IT systems that can be difficult to integrate with new technologies. Additionally, there may be resistance to change from employees and customers who are used to the traditional ways of doing things.

The importance of technological advancements in the insurance sector cannot be overstated. With evolving customer expectations and growing competition, insurers must embrace modernization to remain relevant and competitive in the digital era. By implementing a holistic digital strategy that incorporates tools such as DXPs, insurers can unleash the complete potential of technological advancements and deliver enhanced value to their customers.

How does digital transformation benefit customers?

Digital transformation in insurance offers several benefits to customers, enabling them to access better digital products and digital services, improved customer service, and enhanced user experiences. Here are some key benefits of digital transformation for insurance customers:

Convenience: It becomes easier for customers to access insurance products and services, regardless of location or time of day. Customers can now purchase insurance policies online, file claims, and track the status of their claims in real-time, without needing physical visits to insurance offices.

Personalization: Insurers could offer a more personalized experience for customers based on their data and preferences. Customers can receive personalized policy recommendations, personalized pricing based on their risk profiles, and personalized communications.

Faster Claims Processing: Insurers can process claims faster, reducing customers' wait time for payouts. This is achieved by leveraging artificial intelligence, machine learning, and automation.

Improved Customer Service: It would enable insurance companies to provide better customer service, faster response times, and improved issue resolution. Customers can now access support through various digital channels, including email, chatbots, and social media. This would greatly improve customer satisfaction.

Transparency: There is improved transparency in the insurance industry, giving customers greater visibility into the claims process, policy terms and conditions, and pricing strategies.

In general, the advancements in digital technology empower insurance customers by simplifying access to insurance products and services, enhancing personalization and customer service, and promoting transparency. As insurers persist in investing in technological advancements, insurance customers can anticipate a further array of advantages in the future.

Why use a DXP?

The insurance industry incumbents face mounting competition from digital-first disruptors rapidly taking over market share. Coupled with shifting customer expectations, where they expect seamless online experiences and great customer service across channels (self-service, online search, and purchase, etc.) - much like other sectors, the adoption of modernization initiatives has become imperative for insurance companies to maintain their market standing and protect their expansion. A DXP plays a vital role for insurance companies seeking to undergo their digital evolution.

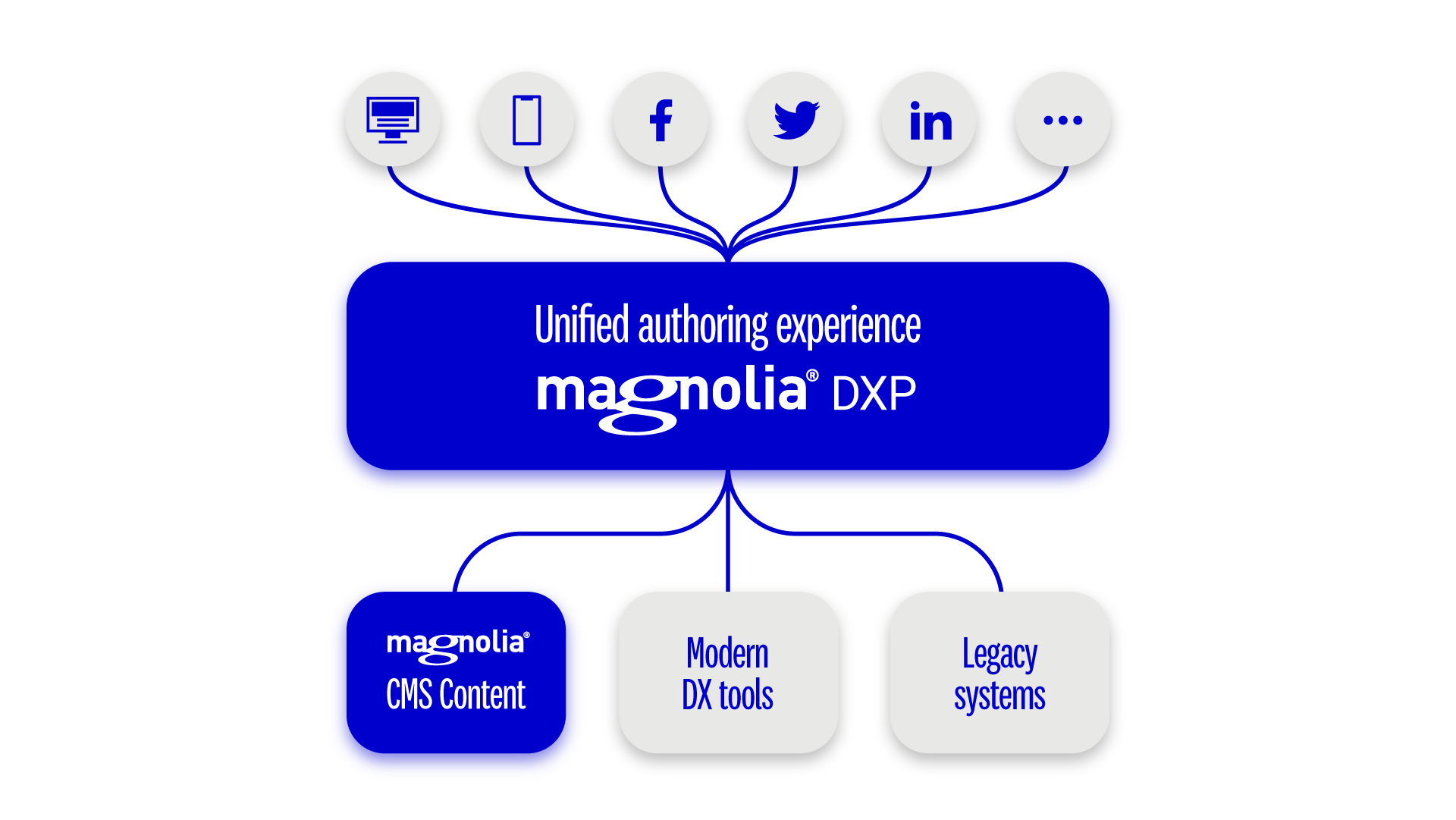

A composable DXP is needed to achieve digital evolution. A DXP such as Magnolia can help insurers with this process. Insurers typically have lots of isolated legacy technology. Magnolia's strength is in integrating with legacy systems while enabling the integration of modern DX tools to keep up with the competition. Magnolia's approach avoids vendor lock-in and complements existing technology and investment.

Taking control with Magnolia’s DXP

Magnolia's composable DXP enables all digital tools to be integrated into one user interface so that editors get a great authoring experience in Magnolia and don’t have to switch between tools.

Magnolia’s composable DXP provides a UI for non-technical users for unified experience orchestration, including a content management system (CMS), visual editing for any frontend (Visual SPA Editor), multi-source content, multi-site and multi-language management capabilities, digital asset management and image optimization, with omnichannel delivery.

No big bang change is needed - with Magnolia’s composable DXP, an incremental transition is possible. It’s also flexible so that new digital tools can be added and replaced.

Magnolia DXP provides the tools to communicate with potential customers and turn them into paying clients. Due to its API-based approach, it’s easy to integrate with third-party tools if its suite of tools does not completely match an insurance provider’s requirements. Additionally, the Magnolia DXP can help with every touchpoint during the customer journey, starting with the distribution, and can create new post-sale touchpoints by, for instance, offering tips on claims management and other subjects to assist clients, strengthening ties, and boosting client lifetime value.

The key to effective distribution is delivering the appropriate content through the right channels to the right audiences. Insurance companies can utilize Magnolia to manage the medium and the message, whether they communicate directly or through intermediaries.

Magnolia for insurers

A DXP (digital experience platform) brings a wealth of benefits for insurers, and Magnolia is leading the pack.

Handling content distribution

In an increasingly crowded and commoditized market, it’s even more important to be found and offer a great experience different from other offerings on the market so people convert.

Some of the ways Magnolia can help improve distribution are:

Integration with leading SEO tools like Siteimprove: A strong online presence requires search engine optimization (SEO). Magnolia's DXP makes it simple to frame material to be visible to various audiences. The Siteimprove connector, a part of the Magnolia Optimization Connector Pack, enables Magnolia customers to check page stats affecting the SEO performance of a page before publication - directly in Magnolia.

A Great Digital Experience on the Website: To successfully transform digitally, insurance companies must ensure that their digital initiatives are designed with accessibility in mind, provide clear guidance for users to navigate the platforms and services, personalize content to meet individual needs and preferences, deliver campaigns at the right time and place through multi-channel strategies, create a seamless experience that is fast and easy to use without the need for technical expertise or development skills, and ultimately meet the expectations of users by providing great content that meets their needs.

Seamless quotes digital experience

Getting quotes is essential to the insurance industry, providing customers with estimated premiums and coverage options for various insurance policies. Insurance quotes are typically based on factors such as age, location, driving history, and other relevant information. With the rise of digital technologies, customers can now obtain insurance quotes online from the comfort of their homes. The ability to provide quick and accurate insurance quotes online has become a competitive advantage for insurance companies, as customers increasingly prefer to research and purchase insurance policies on online platforms.

Luckily, Magnolia simplifies this process for insurance firms by providing a tool that makes it easy to create easy-to-manage conversational forms that streamline the process of turning quotes into insurance policies. Additionally, Magnolia is highly flexible and easy to integrate with existing third-party tools used to sell insurance policies online.

Conversational forms are designed to mimic a conversation between a user and a computer system or application. Instead of rigid fields and fixed structures, conversational forms allow users to interact more naturally and conversationally. Users can provide information through text input, voice commands, or selecting options from a set of choices presented in a conversational manner. This way, people don’t get overwhelmed by lengthy forms, and it feels more personal.

The Magnolia quotes experience ensures every conversation counts by ensuring you positively engage with customers from the moment you start talking, increasing the likelihood of conversions.

Enhancing claims prevention

Claims prevention has become a significant focus for insurers in recent years. Customers expect their insurance providers to offer protection against financial losses and provide guidance and support to help them mitigate the risks of potential claims. According to a study, 64% of consumers want their insurance company to provide information to help with claims and loss prevention. However, traditionally there has been limited interaction between insurers and policyholders, except when a claim is filed or it is time for policy renewal. This lack of engagement means insurers miss opportunities to build stronger customer relationships and provide value-added services.

By leveraging Magnolia's DXP, insurers can connect with their customers more effectively and offer them the support they need to prevent claims. The platform can enable insurers to provide their customers with personalized and relevant content on claims prevention and risk management. Insurers can use Magnolia to create informative blogs, interactive tools, and other digital resources that their policyholders can access anytime and anywhere, making it easier to take proactive steps to reduce the likelihood of a claim.

Moreover, Magnolia's platform allows insurers to be present in their policyholders' lives more regularly, even during non-claim periods, creating opportunities for insurers to build stronger relationships and increase customer loyalty. By providing value-added services and resources, insurers can differentiate themselves from competitors and offer a more holistic customer journey.

In summary, insurers can leverage Magnolia's DXP to improve claims prevention and create more significant engagement with their policyholders. By providing valuable resources and services, insurers can strengthen their relationships with customers and reduce the number of claims, ultimately enhancing their bottom line.

Conclusion

The insurance industry is undergoing significant changes, with digital evolution at the forefront. With the rise of digital-first disruptors and shifting customer expectations, insurers need to embrace new technologies and tools to remain competitive and meet the evolving needs of their customers. Magnolia's Digital Experience Platform provides insurers with the tools to deliver a seamless and personalized customer experience, increase engagement, and improve claims prevention.

By leveraging Magnolia's platform, insurers can transform their digital capabilities and unlock new opportunities for growth and profitability. Ultimately, it is clear that a Digital Experience Platform is the key to unlocking digital evolution in the insurance industry, enabling insurers to succeed in a rapidly changing landscape.