Unification allows more independence

R+V Versicherung is one of Germany’s largest insurers for private and business clients. Founded in 1922 and based in Wiesbaden, the company belongs to the FinanzGruppe cooperative banking association and employs more than 16,000 people (as at 31 December 2020). R+V supports almost nine million clients with around 26.5 million insurance solution policies.

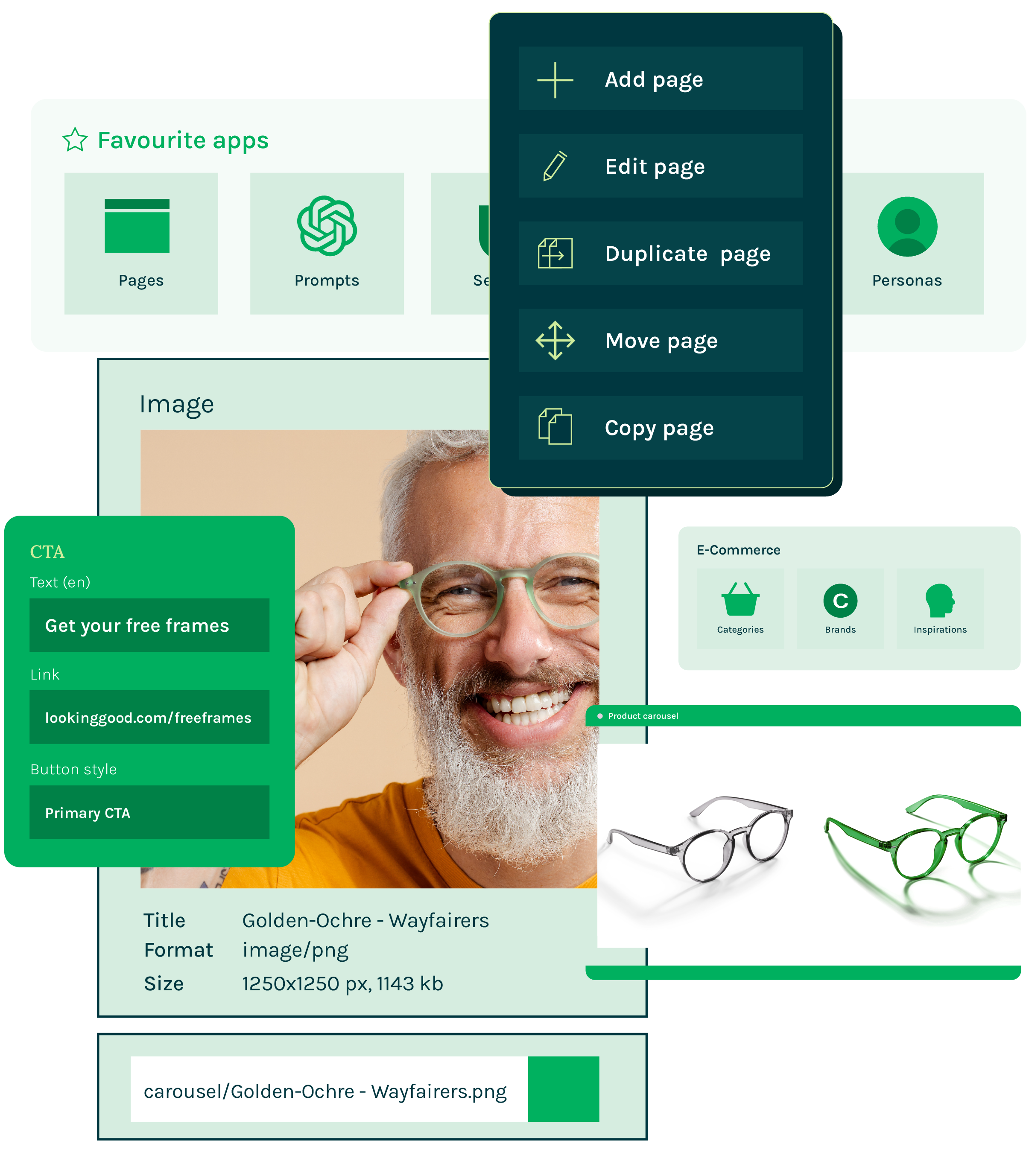

R+V Versicherung has numerous web presences and was looking for a way to standardise and simplify how they are managed. With the CMS from Magnolia, R+V has completely restructured its content management, enabling the different online presences to be managed independently in separate backend areas, while the user experience remains the same for each of these areas.

Highlights

The Challenge

The Challenge

Combining content management for numerous R+V websites

The online presence of R+V Versicherung comprises several websites. The many different subject areas on the main sites www.ruv.de and www.rv24.de alone require a great deal of administrative work in content management. Plus, more than 400 websites of local general agencies operate via R+V’s content management system. The challenge is to build a central content management platform for the different editorial teams in the company. Requirements for the new content management system: It should be multi-client-capable and multi-site-capable. At the same time, a CMS was needed that is suitable for the finance and insurance sector and thus meets the strict requirements for quality, security and functionality as well as user-friendliness.

The Solution

The Solution

Successive roll-out by Magnolia

On the basis of a detailed software evaluation, R+V Versicherung decided to roll out the content management solution from Magnolia, implemented by digital agency and Magnolia partner neofonie. The software was rolled out step by step beginning in September 2020 and the migration from the old CMS carried out. The content platform from Magnolia was seamlessly integrated into the existing system infrastructure. The familiar functions of all R+V websites were transferred to the new CMS. At the same time, R+V used the migration to revise the layout of the website.

Restructuring the website with multi-client-capability

The many different areas of the R+V website were restructured, standardised and then integrated in Magnolia in the course of the implementation. This gave R+V Versicherung independent areas for the individual websites in the CMS backend. As such, the website sections for private clients, business clients, press, advice, corporate content, careers and the MyR+V area as well as the sites of the 400 or so general agencies can now be managed independently of one another in separate backend areas.

Content migration

For the R+V online presences, the CMS also had to meet the strictest quality standards. The solution was a highly available infrastructure that mapped the migration of the content. To do this, a deployment process was implemented and several test levels developed using Docker and Ansible. The migration of the R+V content was partially automated. Special editorial and functional content was programmed retrospectively. The entire migration ran in mixed operation during the transition phase from the old CMS to Magnolia – the end users did not notice the changeover at all.

The Result

The Result

Greater efficiency and security in R+V’s editorial work

The finance and insurance sector has particularly exacting security standards for content management. These were implemented successfully with the roll-out of Magnolia. The R+V website has now achieved the top grade of A in the Security Headers Rating. Plus, editorial work has been made considerably easier by central management in the CMS from Magnolia.

At the same time, Magnolia also offers a great deal of scope for individual editing. For universal content and general functionalities, templates were created to guarantee greater efficiency and uniformity. What’s more, detailed workflows were generated for processing content that also offer greater security in editorial work.

Magnolia for insurers

A DXP will help established insurers build on their core strengths. With Magnolia, you’ll stay ahead and enhance every customer touchpoint.