- Sep. 11, 2023

- 15 min

The power of omnichannel experience in the insurance industry

Magnolia in Aktion

Unser Expertenteam zeigt Ihnen live, was Magnolia für Sie leisten kann.

Jetzt Demo buchenIn the past, insurance interactions primarily relied on face-to-face human contact or phone calls. However, with the rapid advancement of technology and changing customer expectations, insurance companies have recognized the need to adapt and evolve their digital service delivery. In today's digital era, omnichannel ecommerce is a driving force in the insurance industry.

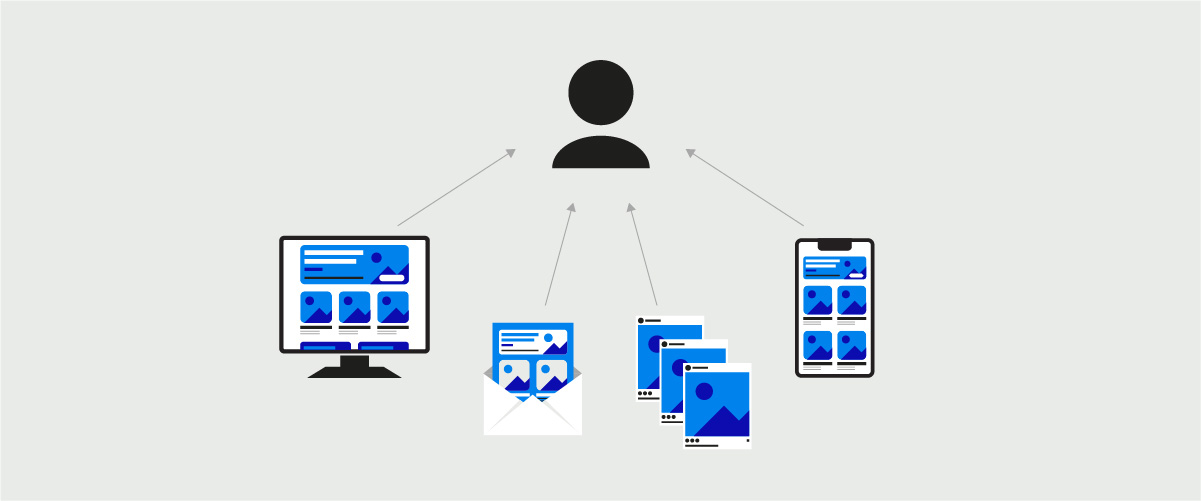

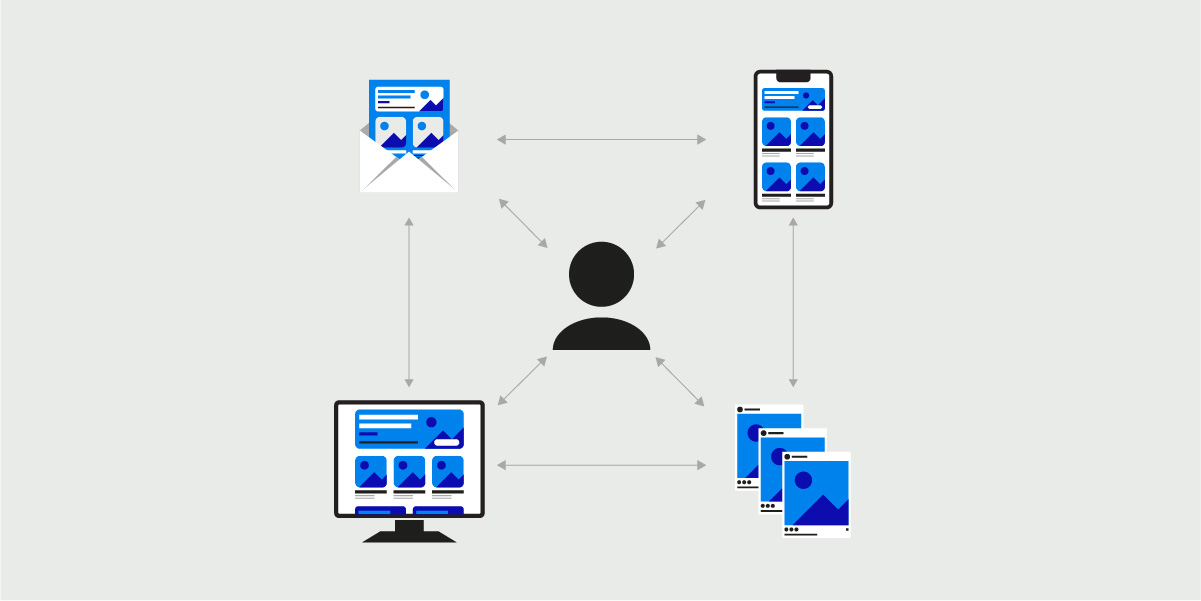

The key idea behind omnichannel insurance is to provide a consistent experience across multiple touchpoints. Whether a customer initiates a policy purchase online, seeks support through a mobile app, or visits a physical office for assistance, omnichannel insurance ensures that the customer's information, preferences, and history are readily available to the insurance provider. The result is a uniform and positive experience for customers because their needs are always placed first.

This article will embark on a deep dive into omnichannel insurance. We will uncover how insurers can outperform the competition by crafting tailored strategies prioritizing individual preferences and needs.

Understanding omnichannel experiences in insurance

Have you ever wondered about the distinctions between multichannel and omnichannel experiences? Let’s explore both approaches.

Multichannel experiences

Multichannel experiences involve multiple channels for customer interaction. However, these channels may not be well-integrated, leading to disjointed experiences. In a multichannel approach, each channel operates independently, and there may not be a seamless transition or consistent sharing of information between channels.

Imagine a customer looking for the right insurance policy. They visit an insurance company's website, exploring the various insurance products. They find a policy they are interested in, and decide to initiate a purchase online. However, they have questions and use the live chat.

While happy to assist, the insurance rep in the chat lacked visibility into the customer's online activity or the specific policy they were looking at. The customer must explain their situation again and reiterate their preferences, resulting in a disjointed and frustrating experience. In a world where technology enables smooth transitions and personalized interactions, this fragmented approach won't meet customer expectations. That's why omnichannel experiences are so important.

Omnichannel experience

Omnichannel experiences take multichannel experiences further by providing a seamless customer experience across different channels and touchpoints throughout the insurance journey, where the customer can switch between channels while maintaining consistency and continuity. It integrates various communication channels, such as digital platforms, call centers, and physical offices, to create a unified and cohesive omnichannel customer experience.

In an omnichannel experience, a customer’s journey might again begin by researching insurance policies on the company's website and finding one they like, but they may need to dig deeper and ask questions. For instant assistance, they again use live chat, where the representative efficiently answers the questions and finalizes the purchase on the customer's behalf, ensuring a seamless and consistent experience.

What are the advantages of omnichannel experiences to insurers?

In the dynamic realm of insurance, where traditional meets digital, omnichannel experiences emerge as a game-changer. It's not just a concept; it's a strategic pivot that captivates both long-standing insurers and innovative newcomers.

Recalling our earlier scenario of a customer exploring insurance products online, then seeking guidance through customer service and the resulting frustration from a less-than-smooth transition. This scenario underscores why omnichannel experiences matter in ensuring coherent customer journeys.

Yet, the relevance goes beyond convenience. Let's delve into the diverse relevance of omnichannel experiences for insurers:

Meeting customer expectations: Customers today have higher expectations for their interactions with insurance companies. They expect convenience, personalization, and the ability to engage through multiple channels. They want the same seamless interactions and convenience that they experience from digitally sophisticated service providers such as Amazon. By providing an omnichannel insurance experience, insurers can meet these expectations and strengthen their customer relationships.

Enhanced customer experience: Customer experience is a crucial differentiator for all businesses and insurance is no exception. And today that means digital experience. Insurers must differentiate themselves in a highly competitive market and provide exceptional customer experiences. Insurers can build stronger customer relationships and increase customer lifetime value by investing in omnichannel strategies that deliver a superior digital experience.

Competitive advantage: The rise of insurtech startups has introduced new insurance players who prioritize digital innovation and customer-centricity. Providing omnichannel experiences helps incumbents compete with startups and stand out from competitors who lack integrated channels. This differentiation can attract new customers and help retain existing ones.

Operational efficiency: Integrating channels and streamlining processes through omnichannel strategies can improve operational efficiency. Insurers can reduce duplication of efforts, minimize errors, and automate routine tasks, allowing employees to focus on higher-value activities. This efficiency improves productivity and reduces costs.

Next, let's explore how insurers can harness the power of omnichannel strategies to create seamless customer journeys, increase engagement and build lasting value.

Omnichannel strategies

Omnichannel strategies refer to the approach taken by businesses, including insurers, to provide a seamless and integrated customer experience across multiple channels and touchpoints. An omnichannel strategy will align and coordinate different communication channels, both digital and physical, to create a unified and cohesive customer journey.

Imagine walking into an insurance office and chatting with an agent who understands your needs. Later, while checking your email, you find a policy recommendation tailored just for you. Your insurance experience is seamlessly connected, no matter where you are.

This is the magic of an omnichannel strategy. Think of it as a story that unfolds across different chapters—physical visits and digital interactions—yet always feels like one coherent, consistent journey. In other words, it creates a positive experience.

Omnichannel strategies enable policyholders to interact with an insurance company through their preferred channels, such as digital platforms, call centers, and physical offices. Implementing an effective omnichannel strategy ensures that customers can seamlessly switch between channels while maintaining consistency in their interactions, information, and overall experience.

Benefits of omnichannel strategies include:

Increased customer satisfaction: Omnichannel strategies enhance customer satisfaction by providing a seamless experience across varying channels. Customers can interact with insurers through their preferred channels and have a unified experience. With the support of specialized customer engagement departments, insurers can ensure that customer interactions are personalized, timely, consistent, and highly satisfactory.

Improved customer loyalty: For established insurers, acquiring potential customers is as essential as retaining existing ones. When insurers prioritize omnichannel strategies, they are committed to meeting customer needs. Consistent and personalized experiences across channels foster a sense of trust, reduce churn rates, and foster long-term customer loyalty.

Increased conversions: Omnichannel strategies streamline the digital customer journey, removing friction points and simplifying the purchase process. By providing a seamless transition between channels, insurers can improve conversion rates and optimize their approach to sales. Customers can research, compare, and purchase policies effortlessly, leading to higher conversion and insurance sales.

Data-driven decision-making: Omnichannel strategies generate valuable data on customer interactions, preferences, and behaviors across channels. Insurers can analyze this data to gain insights into customer needs, identify market trends, and make data-driven decisions. This helps insurers refine marketing strategies, business operations, improve products and digital services, and optimize customer experiences.

Implementing omnichannel experiences

As insurers stand at the crossroads of transforming their customer engagement, the journey toward embracing omnichannel experiences becomes paramount. Yet, this transformation isn't without its complexities.

Much like assembling a mosaic, the path to implementing omnichannel experiences involves integration and organizational challenges. Below are some of the main requirements for successful implementations.

Overcoming implementation challenges: Implementing omnichannel experiences can be complex and cumbersome. Omnichannel platforms should provide a user-friendly interface and capabilities that are intuitive and easy to manage. They should allow insurers to seamlessly integrate different tools (e.g., analytics, marketing automation, CDPs, CRMs, etc.) into one user interface and connect to different channels, and deliver consistent experiences across touchpoints.

Building on strength with a great martech stack: Content management is a crucial aspect of omnichannel implementation, especially when insurers have fragmented content across different platforms, sometimes in different languages, and unclear content governance. To achieve a seamless omnichannel experience, insurers need a robust martech stack that provides a centralized content repository that ensures content is consistent, up-to-date, easy to share, and easy to access across channels.

The right tools and processes: Insurers need tools with analytics that provide insights into customer behavior and preferences; personalization tools to provide tailored experiences; content curation tools to manage and organize content effectively; content delivery mechanisms to ensure the right content is delivered through the most appropriate channels for customers; and content presentation tools for consistent and engaging customer experiences.

In addition, a strong content governance strategy is crucial. Insurers must establish clear guidelines, workflows, and approval processes to maintain content consistency, accuracy, and compliance across channels. They must ensure that data privacy and security are not compromised by integrating and sharing data across multiple channels.

A Digital Experience Platform (DXP) serves as a unifying hub, seamlessly integrating channels, data, and touchpoints. A DXP removes the complexities of an ever-evolving digital ecosystem and ensures that customer needs remain the priority.

How DXPs boost omnichannel experiences

DXPs ensure our online experiences are smooth across all channels. They integrate technologies and provide customers with personalized and consistent digital interactions.

Let’s take a closer look at the evolution of DXPs and their role in building effective omnichannel experiences.

It all started with the Content Management System (CMS). A CMS is software for creating, managing, and publishing digital content. CMSs streamline content management processes and provide an intuitive interface for content authors and administrators to develop and organize various types of content, such as text, images, videos, and documents.

As technology evolved, customers wanted more than just plain websites. They wanted websites that knew what they liked and could show them things they would be interested in. This gave birth to Web Experience Management (WEM) platforms. WEMs took the CMS idea and added a touch of personalization, making online visits more tailored to individual tastes.

Enter Digital Experience Platform (DXP). It's the solution that takes digital experiences to the next level. DXPs are like the conductors of a digital orchestra. A DXP integrates digital technologies and tools into one user interface (UI) to deliver cohesive and personalized digital experiences across multiple channels and touchpoints. DXPs typically incorporate content management, customer data management, analytics, personalization, and integration capabilities to support omnichannel experiences.

How do DXPs and CMSs help to build omnichannel experiences?

Let's explore how DXPs enable insurers to overcome challenges and deliver exceptional omnichannel experiences in the dynamic landscape of the insurance industry.

Scalability: Designed to scale with the needs of insurers, DXPs can handle large volumes of content, customer data, and interactions across multiple channels and tools. This scalability allows insurers to expand their omnichannel digital presence, accommodate growing customer demands, and manage an increasing volume of data.

Unified authoring experience: Insurers can create and manage content for different channels without switching between tools. DXPs are the common ground where content from multiple sources converges, providing authors with an intuitive interface to craft content as if it were all native. This unification simplifies content management, ensuring consistency and efficiency while eliminating unnecessary complexities. Whether it is content originating from their proprietary platforms or integrated third-party tools, insurers can create a seamless, hassle-free authoring journey, streamlining the process of delivering engaging omnichannel experiences.

Flexibility: Offering content management and delivery flexibility, DXPs allow insurers to create, edit, and distribute content across different channels to ensure consistent experiences. These platforms support diverse content formats, such as text, images, videos, and documents, and allow insurers to adapt content for different devices and touchpoints. This flexibility enables insurers to deliver personalized and tailored experiences to their customers.

Personalization tools: Equipped with a range of tools and features for personalization, DXPs allow insurers to capture and analyze customer data, segment audiences, and deliver targeted content and offers based on customer preferences and behavior. Personalization enables insurers to create more relevant and engaging experiences, increasing customer satisfaction and loyalty.

Analytics and insights: Integrating powerful analytics and reporting functionalities from established analytics platforms, DXPs excel in tracking customer interactions, measuring engagement, and providing valuable insights into customer behavior, content performance, and campaign effectiveness. Insurers can employ these analytics to optimize their omnichannel strategies, refine their marketing efforts, make data-driven decisions, and continually improve the customer experience.

Choosing a digital experience platform (DXP) for insurers

Find out how a DXP will transform your insurance business and consolidate your role in a changing marketplace.

Tips to get started with omnichannel insurance

Implementing successful omnichannel experiences requires continuous refinement, monitoring, and adaptation. Following these tips can lay a strong foundation for omnichannel insurance business models and pave the way for delivering exceptional customer experiences across multiple channels and touchpoints.

Lay a strong multichannel foundation

A solid multichannel presence is the vital first step in implementing omnichannel experiences. Identify the various channels and touchpoints where customers interact with the brand and evaluate how to optimize each one. Utilize analytics to gain insights into customer behavior, preferences, and engagement across different channels. This enables you to make informed data-driven decisions and enhance the overall customer experience.

Select a project or customer journey

Focus on a specific business project or an online customer journey. Define logical paths across multiple channels and touchpoints, ensuring that each scenario is covered. By mapping these digital journeys, users can identify huge opportunities for personalization at each step. Personalization is crucial in delivering relevant content and offers to customers.

Establish omnichannel as a corporate decision

Implementing omnichannel experiences requires alignment and collaboration across departments within the organization. It's essential that all digital insurance teams, insurance brokers, and physical touchpoints serve common goals and objectives and that there are no information silos.

Craft a cohesive story across channels

Instead of creating content solely for specific channels, develop a cohesive and reinforcing brand story that resonates with customers across all channels. The story should be consistent and tailored to the unique characteristics of each channel while still maintaining a unified message and brand identity.

How Magnolia can help

The Magnolia DXP offers a range of features and capabilities that can significantly support omnichannel initiatives. Magnolia orchestrates multi-faceted omnichannel campaigns that resonate with insurance customers. Through Magnolia, users can create campaigns across different channels and touchpoints, boosting personalization and data integration with a headless architecture.

Magnolia allows users to seamlessly combine diverse experiences, personalized journeys, and data-backed insights. Magnolia's unified authoring offers WYSIWYG editing and previews, enabling users to blend content from various sources and create a cohesive and compelling narrative. Moreover, it can incorporate insights from analytics tools like Google Analytics. This fusion of technologies builds brand equity and strong customer relationships across the many channels that insurers must focus on today to remain competitive and relevant.

Omnichannel campaigns

Omnichannel campaigns are coordinated marketing efforts that seamlessly span multiple platforms, channels and touchpoints, delivering consistent and highly focused content. Magnolia provides marketers with tools to create, manage, and schedule content within a unified platform. They can shape content to suit specific customer profiles and use AI to generate assets.

By streamlining campaign orchestration and providing real-time previews, Magnolia enables marketers to cultivate cohesive omnichannel experiences that engage audiences at every stage of their journey.

Multichannel preview

Magnolia provides a seamless multichannel preview functionality that allows users to toggle instantly between editing and preview modes within the page editor. This feature lets users preview content across various devices and resolutions, ensuring a consistent and engaging experience according to customer preferences. By visualizing how content appears on different devices in a WYSIWYG style, a user can identify potential issues and make adjustments to enhance the overall user experience.

Personalization segments

Magnolia enables users to segment audiences into meaningful groups and define personas to target, ensuring each group receives relevant and personalized messaging. Magnolia can individualize content, keeping customers engaged and delivering relevant experiences based on their specific needs, which increases customer engagement and conversion rates.

Integrated experiences

Save time and effort by creating campaigns once and using them across diverse channels, including web, social media, and mobile. Effortlessly deploy campaigns across various touchpoints, reaching relevant customers easily.

Easy integration

Magnolia seamlessly integrates content and data from different sources, and manages it in a single authoring interface. This eliminates the toggling between different tools, effectively providing a native content experience. As a result, authors can effortlessly and creatively manage content from diverse sources.

Streamlined content management

Magnolia's intuitive and user-friendly interface simplifies the content management process. You can easily create, edit, and organize content within the DXP, making it easy to maintain consistent messaging across multiple channels. With Magnolia, users have a centralized content hub for all content assets, eliminating the challenge of fragmented content and ensuring content governance across the omnichannel ecosystem.