- Apr 29, 2024

- 5 min

Insurers must create new business models to be truly innovative

Magnolia in action

Take 12 minutes and a coffee break to discover how Magnolia can elevate your digital experience.

It is more important than ever, that insurers can evolve and remain relevant in a world where being data-driven and digitally enabled is vital. This message is supported by latest industry trends and reports, including analysts such as Gartner.

For incumbent insurers, the message is clear: you have to act boldly and think big.

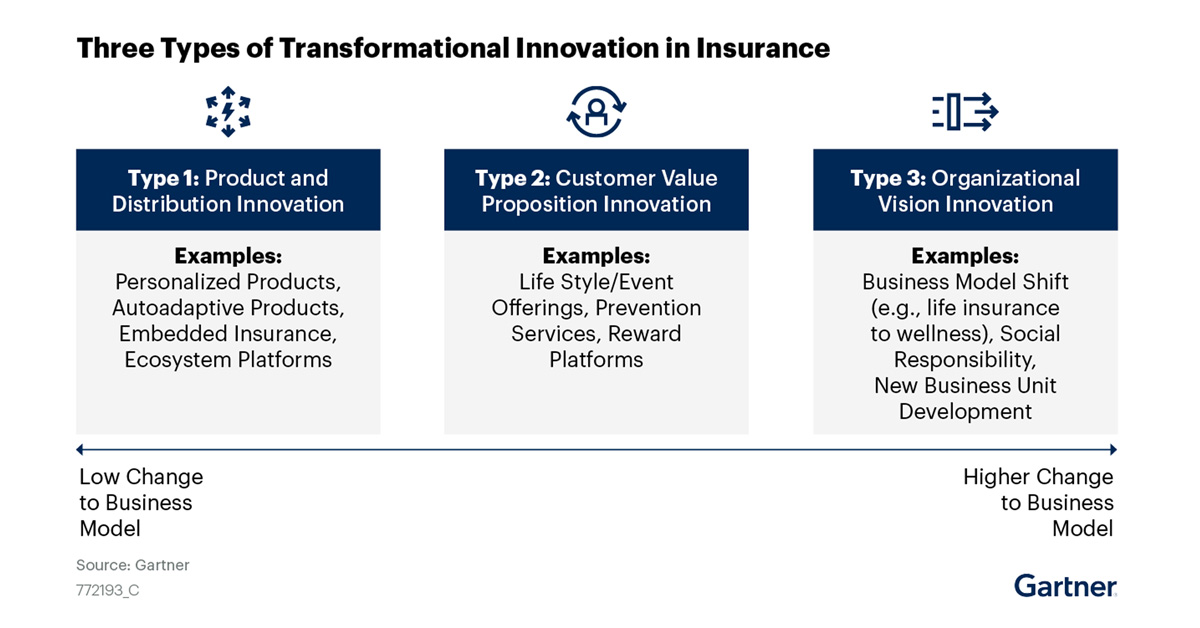

“While many insurers talk about ‘innovation’, few are taking a radical approach to innovation to drive business transformation,” says Gartner. They add that "Innovation has become a main priority of insurers as they fulfill their digital ambitions and seek to identify new business models that will drive success in their market. However, Gartner research has found that most insurers focus on incremental innovation, without focus on business transformation or cultural, talent or process change, which will fail to provide the desired results.".

Modeling the future

Without a clear digital strategy and a commitment to business transformation, piecemeal changes will only scratch the surface. So, what’s the solution? What must incumbents do to future-proof their businesses and remain competitive?

Gartner says, "Insurance CIOs responsible for digital business strategy and innovation should understand and follow the three types of business model innovations:"

Product and distribution innovation. According to our understanding, this is where insurers must identify platform and data/analytics requirements that are beyond the capabilities of most current IT systems, such as innovations to support embedded insurance and ecosystem platforms.

Customer value proposition innovation: We feel this implies better data acquisition and processing to enhance customer experience. Benefits include preventative insurance and more tailored offerings for customers.

Organizational vision innovation. We believe this covers long-term planning that reflects changing values (e.g., ESG) and will lead to new business models. For example, a business model shifts from life insurance to wellness.

We feel insurers are still wedded to process improvements rather than transitional innovations that include business model changes. For insurtechs, innovation and business model developments are easier because they are not encumbered by legacy systems and other constraints. However, incumbents can evolve and reinforce their positions if they embrace the three models by Gartner.

Magnolia for insurers

A DXP (digital experience platform) brings a wealth of benefits for insurers, and Magnolia is leading the pack.

Product and distribution

This first model may involve new products and channels, via digital platforms or partners, and provide personalized insurance or embedded solutions. Gartner says that “with these strategies, companies will seek to reach customers in new ways,” adding that “CX platforms will be necessary.”

“Composable business architecture and open insurance will assist in enabling this vision,” says Gartner, “and become core strategies of innovative CIOs as they support transformation.”

Gartner further highlights: “to achieve open technologies to enable this product and distribution innovation, Gartner also recommends that insurance CIOs should:

Work with business leaders to outline future product and distribution aspirations and identify platform and core system requirements;

Build an ecosystem to support the product and distribution vision to ensure openness to facilitate connectivity and integration and harness APIs and composable business;

Build a platform strategy and consider working with platform partners plus focus on open technologies to enable this.”

Customer value proposition

With the increasing demands of customers and the necessity for insurers to foster stronger customer relationships, Gartner underscores the urgency for incumbents to enhance their value propositions. A prime example of this is claims prevention, a strategy that is gaining significant traction.

In the Customer Experience for Financial Services Survey, Gartner revealed that 64% of consumers wanted their insurers to provide not only innovative insurance products but also information to help with claims and loss prevention.

With claims transformation becoming a hot topic, innovative insurers ”can prepare to outperform competitors in delivering the next generation of customer experiences through leveraging AI and IoT for streamlined claims and data intelligence to identify critical factors for delivering enhanced customer value”, according to Gartner’s Top 10 Technology Trends for P&C Insurance CIOs in 2024 research.

Furthermore, “P&C insurers look to adopt no-touch processing CX through improved risk identification and engagement,” says Gartner. “Instead of solely focusing on how to improve claims processes, many insurers are using data and analytics to identify risks and implement prevention programs.”

Gartner shows that a staggering “72% of consumers want their insurer to provide them guidance on the right products or coverage needed to cover their risks”.

“Insurers need to realize this is not just about the right insurance product, but overall risks associated with living — including healthy living, financial wealth, or home safety. Many insurers lack this intelligence,” says Gartner, “which will prohibit them from advancing.”

Draft a long-term innovation strategy with business leadersCreate agile IT environments to connect with partners

Create agile IT environments to connect with partners including implementing strong analytics platforms;

Build new metrics to assess the business impact of innovation initiatives by identifying new outcomes associated with the growth and risk of new business ventures strategy changes and social initiatives;

Organizational vision

According to Gartner, insurers must embrace social responsibility and be good corporate citizens to reflect consumer and employee values. Above all, they must build trust across all their activities and promote the right organizational vision.

Magnolia and insurance innovation

In our opinion, a digital experience platform (DXP) will provide a firm foundation for the business innovation models proposed by Gartner. Magnolia’s DXP can help insurers transform their businesses and improve every stage of the insurance journey Find out how Magnolia can improve distribution and enhance quotes, and discover how it can prevent claims and reduce loss ratios by helping insurers educate their customers on risk mitigation.

For further information on the role of DXPs and how to choose the right transformation partner, see Magnolia’s white paper: Choosing a digital experience platform (DXP) for insurers.

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally, and is used herein with permission. All rights reserved.